The Best Strategy To Use For Eb5 Investment Immigration

The Best Strategy To Use For Eb5 Investment Immigration

Blog Article

Facts About Eb5 Investment Immigration Revealed

Table of ContentsExcitement About Eb5 Investment ImmigrationOur Eb5 Investment Immigration DiariesWhat Does Eb5 Investment Immigration Do?The Eb5 Investment Immigration DiariesThe Facts About Eb5 Investment Immigration RevealedEb5 Investment Immigration Fundamentals ExplainedThe 45-Second Trick For Eb5 Investment Immigration

The financier requires to maintain 10 currently existing workers for a duration of a minimum of 2 years. The company is currently in distress. Need to generally stay in the exact same location as the venture. Financiers may discover infusion of $1,050,000 exceptionally difficult and dangerous. If an investor likes to invest in a regional facility business, it may be far better to purchase one that only requires $800,000 in financial investment.Financier needs to show that his/her financial investment produces either 10 straight or indirect jobs. The basic companions of the local center firm generally benefit from capitalists' financial investments.

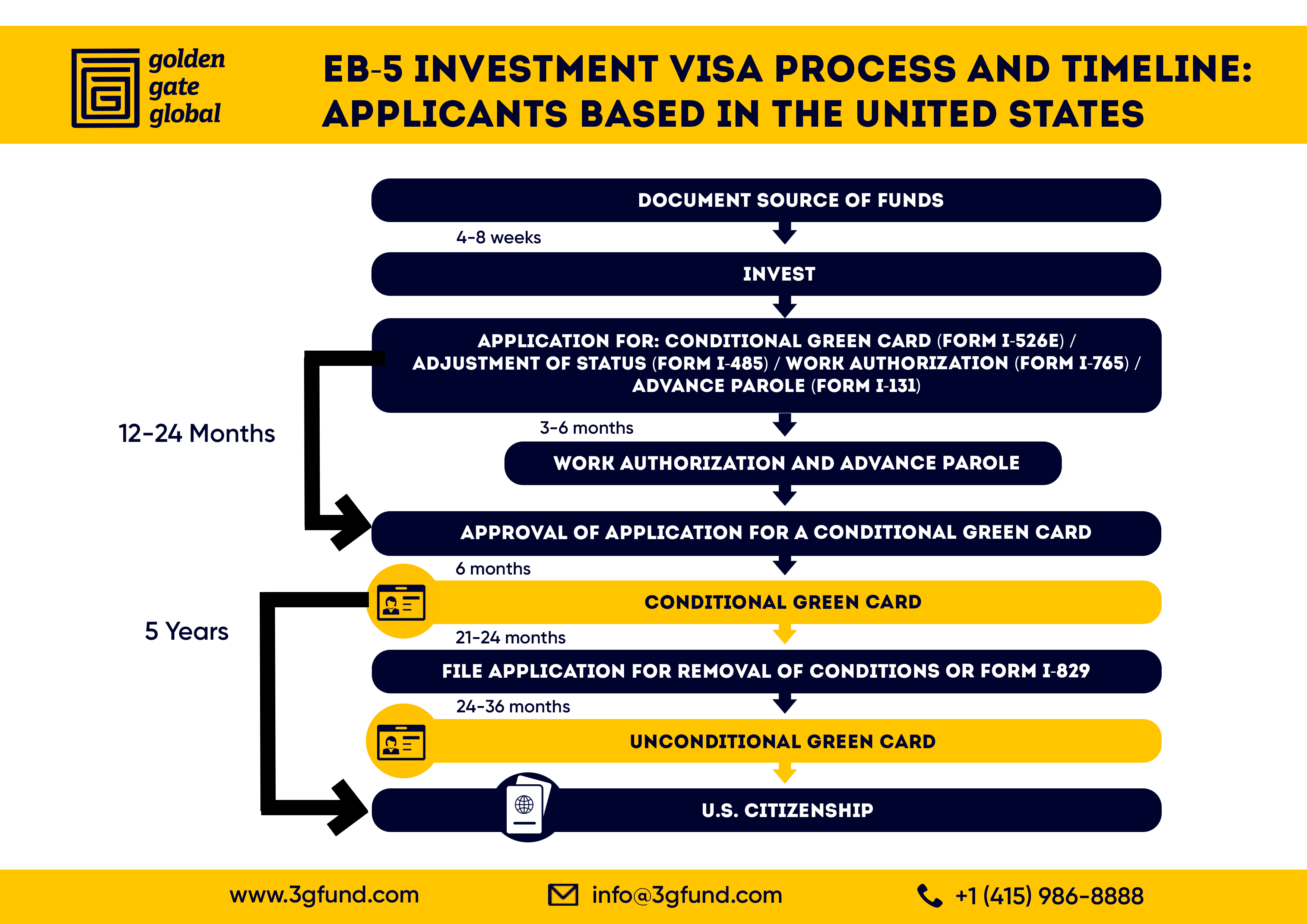

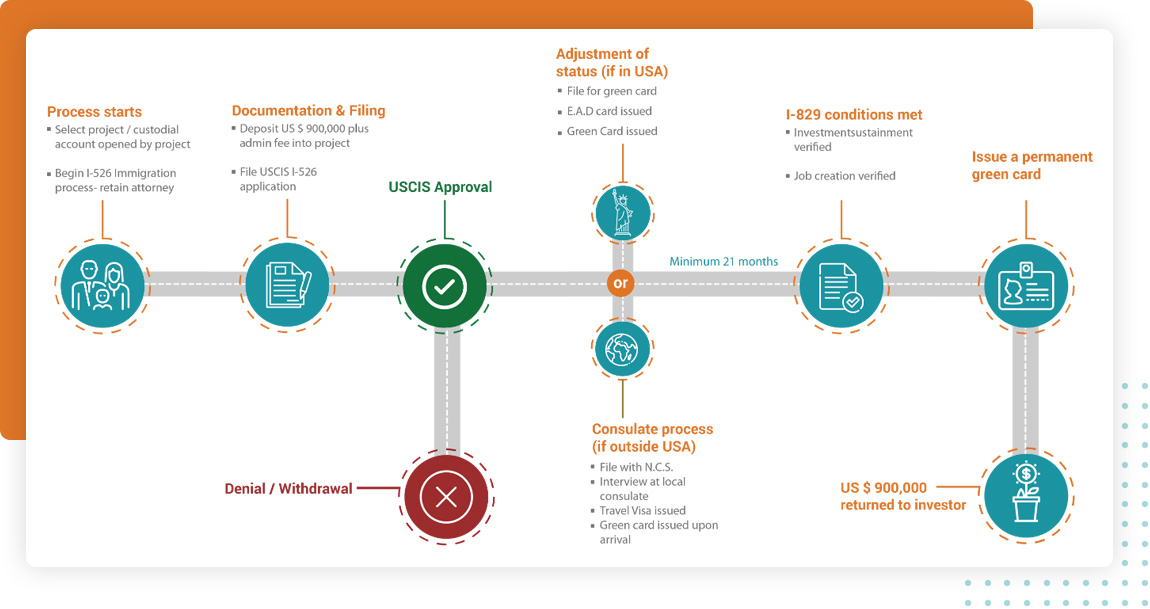

for 2 years. We check your financial investment and work creation progress to ensure conformity with EB-5 requirements during the conditional duration. We aid collect the required paperwork to show that the called for investment and job creation demands have actually been fulfilled. Prior to expiry of the two-year conditional permit, we submit the I-829 request to eliminate problems and acquire irreversible residency status.

Recognizing what this involves, along with financial investment minimums and just how EB-5 investments accomplish copyright eligibility, is vital for any type of prospective financier. Under the EB-5 program, financiers need to meet particular resources thresholds.

Examine This Report about Eb5 Investment Immigration

TEAs consist of country locations or regions with high unemployment, and they incentivize job development where it's most needed. Regardless of the quantity or category, the financial investment has to be made in a brand-new business (NCE) and produce at least 10 permanent jobs for United States employees for an EB-5 applicant to receive residency.

Recognizing the "at danger" need is important for EB-5 investors. The financial investment comes with inherent threats, careful project choice and conformity with USCIS standards can assist capitalists accomplish their goal: irreversible residency for the capitalist and their family and the ultimate return of their funding.

What Does Eb5 Investment Immigration Mean?

To come to be qualified for the visa, you are called for to make a minimal investment depending on your selected financial investment choice. 2 financial investment options are readily available: A minimal straight investment of $1.05 million in a united state business beyond the TEA. A minimum financial investment of at the very least $800,000 in a Targeted Employment Area (TEA), which is a country or high-unemployment location

Upon authorization of your EB5 Visa, you get a conditional permanent residency for 2 years. You would need to file a Type I-829 (Request by Capitalist to Get Rid Of Conditions on Permanent Local Status) within the last 3 months of the 2-year credibility to get rid of the problems to end up being a permanent homeowner.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

In an EB-5 regional facility financial investment, the financier will buy a pre-prepared financial investment structure where the local center has developed a new business. Since it's currently pre-prepared, the local center investments require management charges which would cost $50,000 USD to $70,000 USD. If you're planning to work with a lawyer, there might be lower legal costs as compared to a straight financial investment as there is normally ess job.

However, based on the EB-5 Reform and Honesty Act of 2022, local facility capitalists must likewise send an extra $1, 000 USD as part of filing their application. This added cost does not relate to a changed demand. If you picked the option to make a direct financial investment, after that you would certainly need to attach a company plan together with your I-526.

In a straight investment, the capitalists structure the investment themselves so there's no added administrative charge to be paid. There can be specialist costs borne by the investor to make sure conformity with the EB-5 program, such as lawful costs, business plan writing charges, economic expert costs, and third-party coverage costs amongst others.

All about Eb5 Investment Immigration

Furthermore, the financier is also in charge of acquiring a business plan that complies with the EB-5 Visa demands. This added expense could vary from $2,500 to $10,000 USD, relying on the nature and framework you can try these out of business - EB5 Investment Immigration. There can be extra prices, if it would certainly be supported, for instance, by market research study

An EB5 capitalist ought to additionally take into consideration tax factors to consider throughout of the EB-5 program: Given that you'll end up being a long-term citizen, you will go through earnings taxes on your worldwide income. Furthermore, you have to report and pay taxes on any kind of earnings received from your financial investment. If you sell your financial investment, you may undergo a funding gains tax obligation.

Once you have actually ended up being an U.S. person and you've gotten residential properties in the process, your estate might go through an inheritance tax as soon as you have actually passed away. You might be also based on local and state taxes, other than federal tax obligations, depending upon where you live. An application for an EB5 Visa can obtain costly as you'll have to think of the minimum financial Related Site investment quantity and the climbing application charges.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

The U.S. Citizenship and Migration Solution (USCIS) EB-5 Immigrant Financier Program is carried out by the U.S. Citizenship and Migration Providers and is controlled by government laws and guidelines. The EB-5 visa program permits professional investors to become qualified for copyright on their own and their dependent household members. To qualify, individuals have to invest $1 million in a brand-new business that produces 10 tasks.

The locations beyond metropolitan statistical locations that qualify as TEAs in Maryland are: Caroline Region, Dorchester Region, Garrett Area, Kent Region and Talbot Area. The Maryland Department of Commerce is the marked authority to license locations that certify as high joblessness locations in Maryland according to 204.6(i). Commerce certifies geographic areas such as regions, Demographics assigned locations or demographics tracts in non-rural areas as locations of high joblessness if they have unemployment rates of at least 150 percent of the nationwide unemployment price.

5 Easy Facts About Eb5 Investment Immigration Explained

We assess application requests to certify TEAs under the EB-5 Immigrant Financier Visa program. Demands will certainly be reviewed on a case-by-case basis and letters will certainly be released for areas that satisfy the TEA needs. Please i was reading this evaluate the steps listed below to figure out if your recommended project remains in a TEA and adhere to the instructions for requesting a certification letter.

Report this page